Chapter 1

Influencing people: Myths and Mechanisms

- Why do people buy bottled water that is available free from the tap?

- Why does advertising work on everybody else but not on us?

- Why do advertisers keep repeating an ad that we have already seen?

All these questions reflect the general belief that advertising works by persuading us, yet we don’t feel personally that we are at all persuaded by it.

Why is it so difficult for us to introspect on advertising and how it influences us? Because we look for major effects, that’s why! Too often, we look for the ability of a single ad to persuade us rather than for more subtle, minor effects. Big and immediate effects of advertising do occur when the advertiser has something new to say. Then it is easy for us to introspect on its effect.

But most effects of advertising fall well short of persuasion. These minor effects are not obvious but they are more characteristic of the way advertising works. To understand advertising we have to understand and measure these effects. When our kids are growing up we don’t notice their physical growth each day but from time to time we become aware that they have grown. Determining how much a child has grown in the last 24 hours is like evaluating the effect of being exposed to a single commercial. In both cases, the changes are too small for us to notice. But even small effects of advertising can infl uence which brand we choose, especially when all other factors are equal and when alternative brands are much the same.

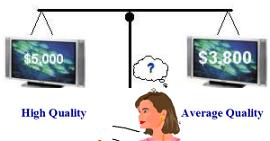

Weighing the alternatives: Evaluation

Low involvement:

Deciding between 2 virtually

identical alternatives.

It is easiest to understand this with low-involvement buying situations. The situation is like a ‘beam-balance’ in which each brand weighs the same. With one brand on each side, the scale is balanced. However, it takes only a feather added to one side of the balance to tip it in favor of the brand on that side. The brands consumers have to choose from are often very similar. Which one will the buying balance tip towards? When we look for advertising effects we are looking for feathers rather than heavy weights. [1]

The buying of cars, appliances, vacations and other high-priced items are examples of high-involvement decision- making. This high level of involvement contrasts with the low level brought to bear on the purchase of products like shampoo or soft drink or margarine. For most of us, the buying of these smaller items is no big deal. We have better things to do with our time than agonize over which brand to choose every time we buy something.

The fact is that in many low-involvement product categories, the alternative brands are extremely similar and in some cases almost identical. Most consumers don't really care which one they buy and could substitute easily if their brand ceased to exist. It is in these low-involvement categories that the effects of advertising can be greatest and yet hardest to introspect upon.

High involvement decisions:

Very different alternatives

can weigh equal.

Even with high involvement products the beam balance analogy is relevant because very different alternatives can weigh-up equal. We often have to weigh up complex things like ‘average quality at a moderate price’ against ‘premium quality at a higher price’. Often we find ourselves in a state of indecision between the alternatives. When the choice weighs equal in our mind, whether it be low involvement products or high involvement products, it can take just a feather to swing that balance.

With high involvement decisions we are more concerned about the outcome of the weighing up process, so we think more about how much weight to give to each feature (quality, size or power)? How many extra dollars is it worth paying for a feature? Automotive writers for example can reach very different opinions. The more complex a product’s features the more complex this assessment because there are usually both positive and negative perspectives. For example, a compact car is positive in regard to both fuel economy and maneuverability but negative in regard to leg-room and comfort.

So which way should we see it? What weight should we give to a particular feature in our minds? When, advertising emphasizes points that favor a brand, it doesn’t have to persuade us - merely raise our awareness of the positive perspectives. Chances are we will notice confirmatory evidence more easily as a result. When we subsequently read a newspaper or consumer report or talk with friends, research shows that we are prone to interpret such information slightly more favorably [2]. This effect is a long way from heavyweight persuasion. Rather it is a gentle, mental biasing of our subsequent perceptions, and we see in Chapter 2 how perspective can influence our interpretation. It is not so much persuasion as a shifting of the mental spotlight...playing the focal beam of attention on one perspective rather than another.

Repetition

Small cumulative increments:

We don’t notice a child’s

growth in 24 hours.

As with the amount by which our kids grow in a day, we are just not aware of the small differences advertising can make. Even though these imperceptibly small changes in time add up to significant effects, individual increments are too small for us to notice. They are just below the just noticeable difference (JND).

Through the process of repetition these small increments can produce major perceived differences between brands, but we are rarely aware of the process taking place.

The cumulative effects of changes in brand image become starkly noticeable only in rare cases: for instance, when we return home after a long absence and find that an old brand is now seen by people in a different light — that in the intervening period the brand has acquired a different image.

Registering a claim in our minds (e.g. ‘taste the difference’ or ‘good to the last drop’) does not necessarily mean we believe it. However, it makes us aware that there are claimed differences between brands. This is a proposition (a ‘feather’, if you will) that, when everything else is equal may tip the balance of brand selection, even if only to prompt us to find out if it is true.

Repetition increases our familiarity with a claim. In the absence of evidence to the contrary, a feeling of greater likelihood that the claim is true begins to accompany the growing familiarity. This effect of repetition is known as ‘the truth effect. [3]

We tend to think that if something is not true somehow it would somehow be challenged. If it is repeated constantly and not challenged, our minds seem to regard this as prima facie evidence that perhaps it is true. The effect of repetition is to produce small but cumulative increments in this ‘truth’ inference. It is hardly rational but we don’t really think about it. We don’t go out of our way to think about it because low involvement, by definition means we don’t care much anyway. Such claims are ‘feathers’.

In summary, the reasons we are unable to introspect on advertising’s effects — especially in low-involvement situations are:

-

the effect of each single ad exposure is small;[4]

-

with repetition, even imperceptibly small effects can build into larger perceived differences between brands;[5]

-

if something gets repeated constantly without challenge, our minds seem to regard this as prima facie evidence that maybe, just maybe, it is true (the ‘truth’ effect);

-

often it is no big deal to us which of the alternative brands we choose, anyway.

If you have ever wondered why advertisers seem to persist in repeating the same ad — if you have ever wondered why they think this could possibly influence sane people like us — then here is the answer. Much of advertising creates only marginal differences, but small differences can build into larger differences. Even small differences can tip the balance in favor of the advertised brand. This is especially true of ‘image advertising’.

Image advertising

The effect of image advertising is easier to see in relation to high-involvement products, so let us start with a high-involvement example — Volvo cars.

Volvo traditionally focused its image advertising on safety. Through repetition, it built up a strong image of the Volvo as a safe car. Other brands have caught up a lot in recent years but on a scale of 1 to 10 for safety, most people would still rate Volvo higher than almost any other car. Safety is now an integral part of our perception of this brand. (The fact that the car actually delivers on this promise has of course been a very important ingredient in the success of the safety campaign—but that is another story.)

One effect of image advertising, then, is to produce gradual shifts in our perceptions of a brand with regard to a particular attribute — in Volvo’s case, safety (in other words, to effect marginal changes in our mental rating of the brand on that attribute). This is often not perceptible after just one exposure because the change, if it occurs, is too small for us to notice.

Now let’s take a low-involvement product in the very late stages of its product life cycle—hair spray—and tease out some insights from its history of brand image advertising.

The first brands of hair spray originally fought for market share on the basis of the attribute of ‘hair holding’. That is, each brand claimed to hold hair. To the extent that they all claimed the same thing, they were what we call ‘me-too’ brands.

To break out of this, one brand began to claim that it ‘holds hair longer’. Just as Volvo claimed that it was safer, and thereby moved Volvo up higher up the perceived safety scale, so this brand of hair spray made people aware that some brands of hair spray might hold hair longer than others. It then attempted to shift perception of itself on this attribute and marginally increase the mental rating consumers would give it on ‘length of hold’.

Vidal Sassoon Hairspray ad

claiming ‘flexible hold’.

The next brand of hair spray to enter the market, instead of tackling that brand head-on, cleverly avoided doing battle on ‘length of hold’. The new brand claimed that it was ‘long holding’, but also that it ‘brushes out easier’ — a dual benefit. In doing so it successfully capitalized on the fact that hair sprays that hold longer are harder to brush out (or were until then). Many years later, came the attribute of ‘flexible hold’.

These examples of image advertising for hair spray and cars illustrate how one effect of advertising is to alter our perceptions of a brand. Advertising can marginally change our image of a brand by leading us to associate it with a particular attribute (like ‘longer holding’ or ‘brushes out easily’), and to associate the brands in our minds with that attribute more than we associate it with any other competitive brand.

Gauging the effects image advertising has on us is made even more complex because these effects may not operate directly on the image of the brand itself. Image advertising may produce small, incremental differences in the image of a brand, as in the case of Volvo — but sometimes it is aimed at changing not so much the image of the brand itself but who we see in our mind’s eye as the typical user of that brand.

User image

In advertising for Levis, Revlon, Guess, Louis Vuitton, or Dolce & Gabbana, the focus is often on people who use the brand. What changes is not so much our perception, or image, of the product as our perception of the user-stereotype—the kind of person who typically uses the brand, or the situation in which the brand is typically used.

When these brands are advertised, the focus is very much on image but often with this important, subtle difference. The advertising aims to change not how we see the brand itself-the brand image-but how we see:

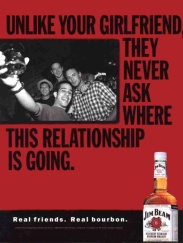

Jim Beam ad reinforcing the

stereotypical user image

- young, single males.

-

the stereotypical user of the brand -the user image;

-

the stereotypical situation in which the brand is used.

If the user image of a brand resembles us, or the type of person we aspire to be, what happens when we come to buy that product category? The user image acts as a feather on one side of the beam balance. If everything else is equal it can tip the scale (but note, only if everything else is about equal).

User, or situational, image changes usually fall short of the kinds of rational, heavyweight reasons that make perfect sense of any choice. But they can nevertheless tilt the balance in favor of one brand. Minor effects such as these constitute much of the impact of advertising. Yet they are usually much more difficult for us as consumers to analyze introspectively, and we tend to discount them because they clearly fall well short of persuasion.

Product image: bottled water

Product image: bottled water

Advertising can marginally change our image not just of a brand but also of a product. When we associate a product in our minds with a desirable attribute, it can infl uence our behavior. Let’s examine the question posed earlier. Why do people purchase so much bottled water when perfectly good water is available almost free from the tap?

The question is, are we in fact drinking bottled water as a substitute for tap water? It may seem that way . . . but is it? Certainly that is not the way it started. In the USA particularly, bottled water’s success can be traced to its original positioning as a substitute not for water but for cocktails and non-alcoholic soda/soft drinks. The image appeal and usage evolved from there.

Let me explain.[5a] In 1977, an American, Bruce Nevin, brought Perrier bottled water to the USA and launched it as a pure and healthier alternative for when you were having a cocktail or some non-alcoholic soda. Consistent with the new emphasis on a healthy lifestyle, it was positioned as an accepted, healthier alternative, especially (though not exclusively) when consumed in social situations. The brand name ‘Perrier’ helped this social acceptance, giving it an up-market ‘designer’ connotation con sistent with France’s fashion and wine image. In addition, the Perrier launch commercials starred Orson Welles, thereby blending celebrity associations with this product. Its appeal as a healthier substitute was buttressed by purity and celebrity and this worked to make Perrier a huge success. With the media constantly urging us to eat more healthily and drink less alcohol, the brand took off. Perrier bottled water became a socially acceptable alternative to drinking alcohol and drinking soda/soft drinks that were not so healthy. Perrier sold US$20 million of bottled water in its first year in the US and tripled its sales to US$60 million the next year. This ultimately attracted other ‘me-too’ entrants.

The next major entrant in the USA was Evian, coming seven years later in 1984. Evian did a ‘me-too’ with pure and healthy while at the same time playing the spotlight of attention on difference in taste. Reportedly, research showed that Americans preferred a still taste to a sparkling taste and Perrier was a sparkling water. So Evian offered a still taste and avoided claiming that it was healthier, but instead cleverly associated the brand with a different aspect of health i.e. active lifestyles and the gymnasium— images associated with young, healthy, toned bodies. Consistent with this active lifestyles image, Evian matched Perrier on celebrity associations by using cool, young celebrities like Madonna (who would drink it on stage).

Such positioning was reinforced even further by Evian being the fi rst to offer a lightweight plastic bottle nationwide. Evian’s lighter, unbreakable bottle was easier to carry and more suitable for on-the-go lifestyles than Perrier’s signature glass bottle. In other words, Evian not only matched Perrier on purity, health, French name connotation and celebrity endorsement but it also projected a user image appeal of toned, active, good looking bodies. If that was not enough of a feather to tip the balance, then being more convenient to carry meant that it was not only ‘cool’ but functional. This paid double dividends for Evian; it extended the way bottled water was consumed and broadened the market to ‘active lifestyle’, socially visible situations.

As new, lower cost entrants like Dusani (from Coca-Cola) and Aquafi na (from Pepsi) came in, the usage of bottled water evolved and extended, further becoming somewhat more commodifi ed. Nevertheless the basic heritage of health and purity is intact and bottled water remains better for us than either soda/soft drink or alcohol. As Charles Fishman noted in his article ‘Message in a Bottle’, ‘. . . today, water has come to signify how we think of ourselves. We want to brand ourselves—as Madonna did—even with something as ordinary as a drink of water . . . We imagine there is a difference between showing up at the weekly staff meeting with Aquafina, or Fiji, or a small glass bottle of Pellegrino.’

The reason we drink bottled water today is partly self branding and partly self statement about healthier lifestyle choices. Did advertising persuade us to use bottled water instead of tap water? No. Did it persuade us to use bottled water instead of less healthy alcohol and sodas? Perhaps that’s closer to the mark, but did anyone feel any persuasion? No. It was not persuasion so much as a series of image influences where virtue, convenience, self branding and self statement were aligned.

Persuasion is the exception

We have been told so often that the role of advertising is to persuade that we seem to have come to believe it.

How often do we hear the comment, ‘It wouldn’t make me run out and buy it.’ This is common in market research when participants are asked to analyze introspectively how they react to an ad -especially if it is an image ad. It demonstrates the myth of how advertising is supposed to have its influence. No-one really believes that any ad will make them run out and buy the advertised product. Nothing has that kind of persuasive or coercive power. So why do people say, ‘It wouldn’t make me run out and buy it’? Because they can’t think of any other way the ad could work. The effect of advertising is not to make us ‘run out and buy’. This is especially true with low-involvement products and especially true with image advertising. It is beam-balance stuff.

High involvement

High-involvement buying contrasts with low-involvement, low-cost purchases. When people are parting with substantial sums of money to buy a TV, a car or a vacation, they do not take the decision lightly. These are high-involvement decisions for most consumers. Before making them, we actively hunt down information, talk with friends and generally find out all we can about our prospective purchase.

Furthermore, the alternative brands available will usually have many more differences. They are unlikely to be almost identical, as is the case with many low-involvement products.

Advertising is one influence in high-involvement buying decisions, but it is only one among many. Often it is a relatively weak influence, especially in comparison with other influences like word-of-mouth, previous experience and recommendations by ‘experts’. In the case of high-involvement products, much of advertising’s effect is not so much on the final decision as on whether a brand gets considered — whether we include it in the set of alternatives that we are prepared to spend time weighing up. This is one of the ways that advertising influences our thinking indirectly. For example, there are hundreds of brands and types of cars, far too many for us to consider individually in the same detail. We seriously consider only those that make it onto our short list. But what determines which cars make it on to our short list? This is where advertising comes into play[6].

If we are unlikely to be in the market for a new car, refrigerator or wall unit for several years, the advertising we see and hear for these products falls on low-involved ears. However, if our old car or appliance unexpectedly breaks down today, we may find ourselves propelled into the market for a new one. Suddenly, the ads we saw yesterday or last week or last month under low-involvement conditions become more relevant. One test of their effectiveness will be whether they have left enough impact to get their brand onto our short list.

A lot of advertising, even for high-priced items, thus has its effect in a low-involvement way. Again we see that, in looking for the effects of advertising, we need to look for subtle effects. It is a case of ‘feathers’ rather than persuasion — ‘feathers’ that influence what alternatives get weighed-up as well as ‘feathers’ that add their weight to one side of the weighing-up process.

Two mental processes in decision-making

There are fundamentally different mental processes at work in choice decisions. We have already considered the most obvious one, the weighing up of alternatives. But there is another process that consumers and advertisers tend to be less conscious of. Weighing up the alternatives is one thing. Which alternatives get weighed up is another!

Which alternatives get weighed up?

What determines the alternatives that are actually considered?

Think about a consumer decision that you probably make every day. It’s getting on for noon, you are feeling hungry and you ask yourself, ‘What am I going to have for lunch today?’ Your mind starts to generate alternatives and evaluate each alternative as you think of it. The process goes something like this:

-

‘Will I have a salad?’ No, I had a salad yesterday.

-

‘A sandwich?’ ‘No, the sandwich store is too far away and besides, it’s raining.’

-

‘I could drive to McDonald’s.’ “Yes . . . I’ll do that.’

There are two things to note here. First, what the mind does is produce alternatives, one at a time. This ‘mental agenda’ of alternatives is ordered like this:

What’s the |

|

Second, the order in which the alternatives are arranged is the order in which they are elicited by the mind. This order can infl uence your fi nal choice. You may enjoy Subway more than McDonald’s. But in the example, you didn’t go to Subway, you went to McDonald’s.

Had you continued your thought process instead of stopping at the third alternative (McDonald’s), you would probably have gone to Subway. But if Subway is only fi fth on your mental agenda of lunch alternatives, it is unlikely to get much of your business. You didn’t get to Subway because you didn’t think of it before you hit on a satisfactory solution—McDonald’s. You didn’t get there physically because you never got there mentally. Even if we like or prefer something, if it is not reasonably high on our mental agenda it is likely to miss out.

How many times have you found yourself doing something and realised too late that there was something else you would rather have been doing but didn’t think about in time? The most preferred alternatives are not necessarily the ones you think of first. (Anyone who has ever left an important person off an invitation list will appreciate this.) Next time you go out for dinner and are trying to decide which restaurant to go to, observe your thought pattern. There are two separate processes at work. One is generation of alternatives. The other is evaluation of the alternatives.

To affect the outcome of buying decisions, advertisers can try to influence:

-

the order in which the alternatives are evoked;

-

the evaluation of a particular alternative; or

-

both.

When we think of advertising’s effects we almost invariably think of how advertising influences our evaluation of a brand. Yet much of advertising’s influence is not on our evaluations of a brand but on the order in which alternative brands are evoked.

Agenda-setting effect

Influencing the order of alternatives has its basis in what is known as the agenda-setting theory of mass communications. This says: The mass media don’t tell us what to think. But they do tell us what to think about! They set the mental agenda.

The agenda-setting theory was originally developed to explain the influence of the mass media in determining which political issues become important in elections. Adroit committee members and politicians claim that if you can control the agenda you can control the meeting. The relevance of this to advertising was recognized over a quarter of a century ago.[7]

We can produce mental |

|

What’s news?

|

What’s the choice

|

We can produce mental agendas for lots of things. We can discover out mental agenda by pulling out what is in our minds under a particular category and examining the order (in which it emerges). The category may be ‘What’s the choice for lunch?’, ‘What’s news’?, or what brand of soft drink should I buy.

When we reach into our minds to generate any of these agendas, the items do not all come to mind at once. They are elicited one at a time and in an order. The items on top of the mental agenda are the most salient and the ones we are most likely to remember fi rst. It’s the same with choosing which restaurant to go to or which department store to visit or which supermarket to shop at this week. It is the same with the decision about which cars or televisions to short-list and which dealers to visit. The order in which we retrieve the items from our memories seems almost inconsequential to us but may be critically important in determining the chances of our going to McDonald’s rather than Subway.

This effect also occurs if we have a list of the alternatives or a display of them such as in the supermarket. Even here, where the brands are all set out in front of us, all of them do not get noticed simultaneously. In fact they do not all get noticed.

Think about the process. We stand there at the display. We notice fi rst one brand, then another and then another. It happens rapidly, but in sequence. So despite the fact that the brands are all displayed, they are not necessarily all equal in terms of the probability that they will come to mind or be noticed. For the last decade, supermarkets have carried more than 30,000 items, up from 17,500 a decade before.[8] This raises a question. At supermarket displays, what makes a brand stand out? To use the marketing term, what makes it ‘break through the clutter’ of all the alternative packs and get noticed? What makes one brand get noticed more quickly than others at the supermarket display?

This introduces the concept of salience, which is formally defined in the next section. In this context we ask how a brand can be moved up from fifth, to fourth to third, to second, to become the first one noticed. The higher up it is in this order, the better the chance it has of being considered, and consequently, the better the chance of its being purchased.

The brand’s physical prominence, the amount of shelf space it occupies and its position in the display are very important. But advertising can influence choice when other factors (like shelf space or position) are otherwise equal. Advertising can help tip the balance.

Asking what makes one brand more salient — more likely to come to mind or get noticed — than another is like asking what influences Subway's position on our mental lunch agenda. In the supermarket, instead of having to recall all the alternatives by ourselves, we are prompted by the display. However, the brands we notice and the order in which we notice them can be influenced by more than just the display.

Salience

We think much more often about people and things that are important to us than about those that are not. The psychological term for this prominence in our thoughts is salience. Advertisers would like us to think of their brands as ‘more important’ but they will settle for ‘more often’.[9] In other words, they would like their brands to be more salient for us.

Our definition of salience is the probability that something will be in the conscious mind at any given moment. One way advertising can increase this probability is through repetition. We have all had the experience of being unable to rid our minds of a song we have heard a lot. The repetition of the song has increased its salience; it has increased its probability of being in the conscious mind at any moment. Repetition of an advertisement, especially a jingle, can have a similar effect. Through repetition of the ad, the salience of the brand - the star of the ad - is increased in our minds.

Another way that advertising influences what we think about and notice is through ‘cueing’. To explain this, answer a few questions.

-

What’s the first thing you think of when you see: "Just Do It."’

-

What’s the first thing you think of when someone says: "Don't leave home without it."

-

What comes to mind if you hear the remark: ‘I’m lovin’ it’?

-

What’s the first thing you think of when someone says: ‘Can you hear me now’?

-

What's the first thing you think of when someone asks "Where's the beef?” in America or "Which bank?” in Australia?

Words or expressions such as these come up naturally in everyday conversation. When a brand is linked to them through repetition, they become cues that help increase the salience of the brand.

An actor in a play takes his cue from a line or some other happening or event. The human mind takes its cue from its intentions and its immediate environment. Such cues can influence what we think about next. That’s how we go to sleep at night. We turn off the cues. We turn off the light and the radio. We try to reduce distractions or cues so that things won’t keep popping into our minds.

One way advertising can use cues is by tying a brand to something that frequently recurs in the ordinary environment. There are many common words, expressions, symbols or tunes that can be developed by means of repetition into mnemonic devices that trigger recollection of the brand.

| Cue (Mnemonic) | Brand/Product | Country |

| I’m lovin’ it | McDonalds | Global |

| You’re in good hands | Allstate Insurance | USA |

| Take care | Garnier | Global |

| Can you hear me now? | Verizon | USA |

| Gimme a break | Have a Kit Kat | USA |

| Have a break... | Have a Kit Kat | UK & Australia |

| Mmmmmmmm... | Big M flavored milk | Australia |

| MmmmmMmmmmm Good | Campbell's Soup | USA |

| Don’t leave home without it... | American Express | Global |

| Do you know me? | American Express | Global |

| Just do it. | Nike | Global |

| Where do you want to go today? | Microsoft | Global |

| The real thing... | Coca-Cola | Global |

| Always... | Coca-Cola | Global |

| Think different. | Apple | Global |

| Because you’re worth it... | L’Oreal | Global |

| Reach out and touch someone | AT&T | USA |

| Thanks! I needed that! | Mennen Skin Bracer | USA |

| Have a good weekend... | ("& don’t forget the Aeroguard”) insect repellant | Australia |

| Good weekend... good VSD | good VSD. VSD Magazine | France |

| Which bank? | Commonwealth Bank | Australia |

| Wednesday... | is Prince Spaghetti night | USA |

| Good on you mum... | Tip Top’s the one. Bread | Australia |

| Where’s the beef? | Wendys Restaurants | USA |

| The car in front is... | "a Toyota” | UK |

| Oh what a feeling... | "Toyota” | USA, Australia |

| Ring around the collar. | Wisk detergent | USA |

| Anyhow*... | Have a Winfield. Cigarettes | Australia |

| I feel like... | ...a Tooheys. Tooheys Beer | Australia |

| Who cares? | Boots Pharmacies | UK |

| You deserve a break today | McDonalds | USA, UK, Aust. |

| Thank you for your support | Bartles and Jaymes wine | USA |

| All because... | the lady loves... Milk Tray | UK |

| Cross your heart... | Playtex Bra | UK & Australia |

If the cue recurs in the circumstances under which the product is likely to be consumed, such as at lunch time, all the better. The ideal mnemonic cue is not just frequently recurring but occurs at these strategic times.

This cueing effect is so much a part of the way we respond to our environment that we are largely oblivious to it. As someone once said, fi sh are probably unaware of water because it is all round them. However, most people are aware of cueing to some degree. Almost everybody has had the experience of a particular smell evoking special memories. Cigars perhaps remind you of your grandfather; the smell of new carpet may trigger a vivid memory of the fi rst day you moved into your new house. When these memories pop into our mind we are then prone to reminisce on those past days.

If you have ever had trouble getting to sleep at night because your mind can’t switch off, you can relate to how involuntary this process usually is. In other words, what pops into our minds at any point in time is not totally under voluntary control.

When you hear the words ‘don’t leave home without......’, the person may be referring to your keys or your coat or whatever... but your mindis involuntarily reminded of American Express. When a driver assures you ‘You’re in good hands’, can your mind help but be reminded of Allstate Insurance? When someone says ‘Just do it’, can you help but think of Nike?

In Australia, Paul Hogan

triggered instant recall

of the brand, Winfield

Celebrities, expressions and music extracts can come to be so ‘owned’ by a brand that they automatically prompt our thoughts in that direction. In the USA Paul Hogan (Crocodile Dundee) is linked to the Subaru brand. In Australia he was traditionally linked to Winfield cigarettes. The word ‘Anyhow*’ still makes older Australians think of Paul Hogan and Winfield cigarettes because it was uttered by Hogan as part of the commercial (Anyhow* . . . Have a Winfield’). Like Joe Camel in the USA, Hogan and the expression ‘Anyhow*’ came to stand for the brand and automatically trigger it in peoples’ minds. Even the classical theme music behind the Winfield campaign came to be thought of as ‘the Winfield music’ and would recall the brand in peoples’ memories. The Marlboro brand did the same thing globally with the theme music from the ‘The Magnificent Seven’ which came to be thought of as ‘the Marlboro music’.

Our minds are in a sense a ‘stream of consciousness’ — an inexorable flow that is frequently diverted, sometimes paused but never stopped. Environmental cues can influence what enters the flow and what direction it takes. One type of advertising focuses on tying a brand to one or more such cues, so that whenever we hear, see or think of the cue there is a high probability that we will think of the brand or notice its presence. It pulls it into our ‘slipstream of thought’.[10]

The product category as a cue

Advertisers want us to think of their brand, but they particularly want us to think of their brand when we are making a decision involving the product category. One important cue is therefore the category itself. When we say ‘soft drink’, what do you think of? When we say ‘lunch’, what do you think of? If our conscious mind is in the process of being cued by a product category (e.g. it is noon and we are thinking ‘lunch’), then what is likely to flit into our head is not a brand of hair gel or a car-we are much more likely to see in our mind’s eye the first item on the mental agenda we have for the category ‘lunch’.

When our mind is cued in to a particular product category, we almost automatically begin to think of the ‘top-of-mind’ members of that category. In the case of the category ‘lunch’, we will think of McDonald’s or Subway or some other food alternative rather than hair gel or cars or anything else..

The technical term for this is category-cued salience, or the probability that the brand will come to mind whenever its product category does.

It is possible to measure category-cued salience and assess the influence of advertising on it. This is done by asking people what is the first brand that comes to mind when they hear or see the product category name, and then the next brand and the next. [11] In this way the agenda of brands can be elicited. The rank of a given brand in the product category agenda indicates its category-cued salience. It is a rough index of the probability that it will come to our mind when in the normal course of events we are prompted by the product category name.

If this questioning procedure is carried out with a different random sample of consumers every week, the agenda and the salience of each brand can be tracked, week by week, over time. Market research can detect any improvements resulting from advertising by the order in which the advertised brand is elicited. Advertising a brand generally improves its salience.

Point-of-sale advertising: How to upset the agenda

Many people wonder why Coca-Cola, which is so well known, needs to advertise so much and why it needs to ‘waste all that money’ on signs in grocery stores. The answer is that if it did not have its signs in these places, Pepsi or some other competitor certainly would. These other brands would try to upset consumers’ mental agendas by ‘jumping the queue’ — by inducing us, at the point of sale, to consider them as well as Coke.

Both point-of-sale, reminder advertising and our own mental agenda of brands can prompt us with alternatives to consider, before we ask for what we want. Advertisers therefore try to influence a brand’s salience at the point of sale by not leaving it to our mental agendas alone. They erect signs in an attempt to visually cue us into their brand.

When we walk into a convenience store to buy a soft drink, we are already in a category-cued state. We are already thinking about soft drink and which one we will have. If Coke is not already top of our mind when we enter, it almost inescapably will be once we have been inside for a moment, because Coke as a brand is likely to be prompted in our minds by a) the product category cue and b) the numerous Coca-Cola signs in the store.

Coke may be on top of most people’s minds but if they are confronted with a Pepsi sign they may consider both brands. So Coke tries to dominate the clutter of mental alternatives as well as the clutter of point-of-sale advertising. This makes it difficult for other brands to cut through into people’s minds at the point of sale. It protects Coke’s category salience — something that it has invested a lot of money in building up through years of advertising.

Supermarket shopping: Mental agendas vs brand displays

In the supermarket, it may be thought that, because the brands are all displayed, they are all equally likely to be noticed -and considered. If this were so, then our mental agenda of brands would be irrelevant to supermarket shopping. However, this is not the case.

On average people take no more than 12 seconds to select a brand and in 85% of purchases only the chosen brand is handled. [12] Observation studies of supermarket shoppers indicate that more than half of all buying is just ‘simple locating behavior’. [13] [14] That is, most people are simply locating the brand they bought last time, or the one that they came in to buy. They put it into their shopping cart, with little or no attention to evaluating the alternatives.

For an alternative brand or pack to be noticed, let alone considered, it would have to cut through the display clutter and stand out in some way. In order to be considered it first has to cut through into conscious attention.

In low-involvement situations many people tend to do what they did last time unless there is something to interrupt the routine. Thus a brand or pack has to cut through the display clutter just as an ad has to cut through the clutter of other ads. And the two, the pack and the advertising, can work together.

The importance of being noticed shows up when regular buyers of a product category are shown color photographs of any new brand. Without advertising and promotional support, the percentage saying that they have seen it on the supermarket shelves will likely remain very low. Of course supermarkets know this and that’s why they insist on a new brand being backed by advertising and promotional support if they agree to stock it.

Just because something is present does not mean we will necessarily notice it or consider it. The more cluttered the environment, the more alternatives there are in the product category, the greater this problem is for the advertiser. Advertising signs at the point of purchase can help considerably here, especially when they tie in with advertising that we have already seen. They are then more likely to ‘connect’ with us and get us to notice the brand.

In the supermarket, it is not signs but usually the brands themselves that are displayed. Potentially we are able to be reminded of every brand in the display by its physical presence. So is our mental agenda of brands still relevant? Yes, though it is now one influence among several. In particular, it orients us by determining which brands we notice in the display.

To illustrate this, imagine you are in a supermarket doing the shopping. As you approach the detergent section, what is in your mind? The category ‘detergents’. Why? Because the layout of the supermarket is familiar to you, or because when you approach that section the category is prompted by the display in front of you.

Even in the supermarket, then, the product category as a cue is likely to be triggered in our minds at a particular point and to trigger in turn expectations of the brands we are likely to see in that category. What we see first in the display is likely to be influenced not only by a brand’s position and shelf space but also by our expectations of seeing the brand there. All other things being equal, we tend to notice first the brands we are familiar with. This is of course especially true when our mindset is that of looking to locate the one that we bought last time.

When something is heavily advertised, it is more likely to come to mind and, other things being equal, to be noticed faster in a display. We know from the psychological literature that people recognize the familiar more quickly, so it will come as no surprise that familiar brands will be very salient and be noticed more quickly. Advertising exposure of the brand and the pack helps to make the brand more familiar and increase its salience. Repeated exposure of the pack in advertising makes it more familiar and hence gives it a better chance of being noticed earlier or faster than its competitor.

Visual salience - the ‘pop-out’ effect.

Inclined letters ‘pop-out’ more

than upside down letters[16].

The importance of this marginal effect is seen in the finding mentioned above-that more than half of all purchases made in the supermarket are simply locating what they want. Shoppers hardly pause at the display but simply reach out and pick up the item they are after. So in the supermarket a brand or pack has to cut through the clutter — to stop people walking at more than 1 mile per hour (2 km/h) — and get itself noticed.

Shelf displays, shelf ‘talkers’ and off-location displays are all ways to help a brand ‘pop out’ and get our attention. Advertising that we have been exposed to previously, however, also plays an important part in increasing the visual salience of a particular brand. The aim is to modify the degree to which the brand ‘pops out’ in the display and engages the shopper’s notice earlier than other brands.

Measuring visual salience

Advertisers can quantify the visual salience of a pack or brand through market research in much the same way as they uncover the mental agenda. They give each brand in a supermarket display equal shelf space and then take a photograph of the display. They show the photo to a random sample of consumers and ask them to name the brands they see. The order and speed with which the brands are noticed provide a measure of their visual salience. (Actually, researchers use several photographs and control for position in the display by randomly changing the position of each brand.)

Summary

One reason we fi nd it diffi cult to analyze advertising’s effects introspectively and why advertising has remained a mystery for so long is that these effects are often so simple and so small that they fall short of outright persuasion. Advertising infl uences the order in which we evoke or notice the alternatives we consider. This does not feel like persuasion and it is not. It is nevertheless effective. Instead of persuasion and other major effects we should look for ‘feathers’, or minor effects. These can tip the balance when alternative brands are otherwise equal and, through repetition, can grow imperceptibly by small increments over time.

Chapter Notes

[1] Referring to this effect as a ‘feather’ is not meant to deprecate its importance. On the contrary, it is meant to give consumers an intuitive feel for why we often find it difficult to introspect on how advertising affects us. We don't feel the effect because it is below the JND (just noticeable difference), but that doesn't mean that feathers aren't important or effective. They are! If an ad has real news to convey, it can become a very big feather, in which case we don’t need an explanation of the effect. Mostly, however, they are much smaller feathers.

[2] John Deighton, ‘The interaction of advertising and evidence’, Journal of Consumer Research, vol. 11, No. 3, December 1984, pp763-770.

[3] Scott Hawkins and Stephen Hoch, ‘Low Involvement Learning: Memory without evaluation’, Journal of Consumer Research, 19, Sept. 1992, pp 212-225

Scott Hawkins, Joan Meyers-Levy & Stephen Hoch, ‘Low involvement learning: Repetition and Coherence in Familiarity and Belief’, Advances in Consumer Research, VXXII, 1995, p63

[4] Even though it may be perceptibly small, a single reinforcement/reminder exposure can have substantial effects on short term sales and market share for well established brands with established ad campaigns. See the pioneering work by John Philip Jones, When Ads Work: New Proof that Advertising Triggers Sales, Lexington NY 1995 and Colin McDonald, From “Frequency” to “Continuity” - Is It a New Dawn?, Journal of Advertising Research, July/August 1997 pp21-25.

[5] M. Von Gonten & J. Donius, ‘Advertising exposure and advertising effects: New panel based findings’, Journal of Advertising Research, July/August 1997, p59

[5a] In this section I am heavily indebted to Charles Fishman’s excellent account that appeared in Fishman, C. (2007). Message in a Bottle. FastCompany.com. July-August.

[6] S. Shapiro, D. Macinnis, & S. Heckler, ‘The effects of incidental ad exposure on the formation of consideration sets’, Journal of Consumer Research, vol 24, June 1997, pp 94-101.

[7] M. Sutherland & J. Galloway, 'The implications of agenda setting for advertising research', Journal of Advertising Research, 1981, Sept. 1983, pp. 52-6

[8] Food Marketing Institute as reported in Businessweek 7/1/96

[9] Andrew Ehrenberg, Neil Barnard & John Scriven, ‘Differentiation or Salience’, Journal of Advertising Research, Nov/Dec 1997, pp7-14

[10] M. Sutherland & S. Holden, ‘Slipstream marketing’, Journal of Brand Management, June 1997,

[11] R. Fazio, P. Herr & M. Powell, ‘On the development and strength of category-brand associations in memory: the case of mystery ads’, Journal of Consumer Psychology, 1992, Vol I (1), pp1-13

[12] P. Dickson & A. Sawyer, ‘ The price knowledge and search of supermarket shoppers’, Journal of Marketing, July 1990, pp. 42-53.

[13] W. Wells & L. Losciuto, ‘Direct observation of purchasing behaviour’, Journal of Marketing Research, Aug. 1966 p227.

[14] M. Sutherland & T. Davies, 'Supermarket shopping behavior: An observational study', Caulfield Institute of Technology Psychology and Marketing Series, no. 1, Aug. 1978

[15] MarketMind proprietary market research tracking for a new brand introduction, 1991

[16] Giusberti et al 1992 as reported in C. Cornaldi et al, Stretching the Imagination: Representation and Transformation in Mental Imagery, Oxford University Press N.Y. 1996